As Vietnam bids to be chip leader, energy and labour woes stand in the way | Technology

[ad_1]

Ho Chi Minh, Vietnam – On a sunny California afternoon in late September, Vietnam’s Prime Minister Pham Minh Chinh took a tour of Silicon Valley, cosying up to officials at semiconductor firms Synopsys and Nvidia.

A little over a month earlier in Hanoi, Pham tasked four government ministries with increasing the number of Vietnamese engineers capable of working in semiconductor production by the tens of thousands.

Government efforts to make Vietnam an attractive option for chip investment have continued in the new year.

Minister of Science and Technology Huynh Thanh Dat last month told local media that authorities had put tax incentives in place for high-value-added products such as semiconductors.

Dat said the country wanted to welcome a “wave” of investment by collaborating with other ministries and tech corporations to boost research and draw talent to the semiconductor sector.

Vietnam has set its sights on becoming a leading player in the global supply chain for semiconductors – the wafer-thin integrated circuits essential to modern technology.

As Hanoi and a bevvy of nations align on the need to de-risk from China amid intensifying geopolitical tensions, the Southeast Asian nation appears to have momentum on its side in its bid to rival the dominance of Taiwan and South Korea.

Yet Vietnam faces obstacles, too, including a limited pool of skilled labour and energy insecurity in the country’s tech manufacturing hub in the north.

The global push to diversify semiconductor supply chains is in step with Hanoi’s development aims, said Le Hong Hiep, a senior fellow at the Singapore-based ISEAS-Yusof Ishak Institute who formerly worked as an official at Vietnam’s Ministry of Foreign Affairs.

“The semiconductor industry is seen as a very important industry that can help Vietnam transform its economy and turn Vietnam into a developed and high-income economy by 2045,” Hiep told Al Jazeera.

“In terms of timing and the strategic setting, it’s favourable for Vietnam to develop the industry now.”

On the surface, Vietnam’s chip ambitions seem to be flourishing amid an influx of foreign capital.

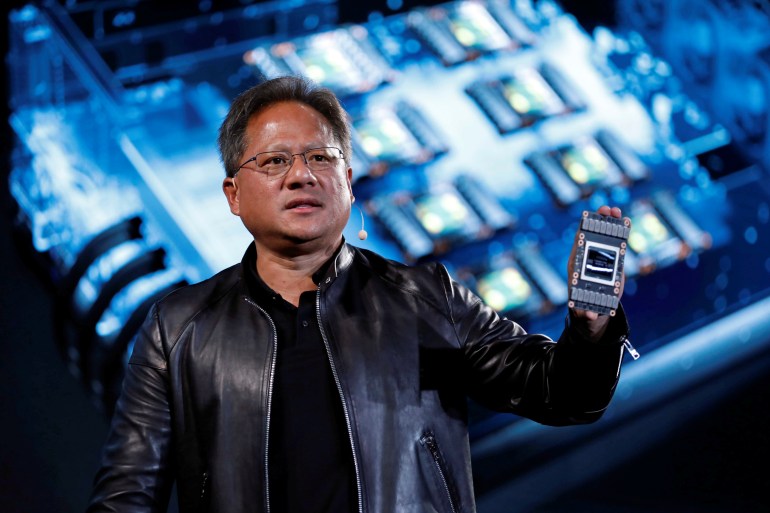

During a visit to Hanoi in early December, Nvidia co-founder and CEO Jensen Huang called Vietnam the chip giant’s “second home”, pledged to expand partnerships with local firms and set up a base in the country, according to local media reports.

Nvidia, whose market capitalisation last week surpassed $2 trillion, says it has invested $12m in the country so far.

A Nvidia spokesperson declined to comment on Nvidia’s future operations in Vietnam when contacted by Al Jazeera.

Vietnam has about 5,000 engineers trained in semiconductors but will need as many as 20,000 in the next five years, according to the US-ASEAN Business Council.

“When companies look at Vietnam, it looks really good on paper but when they actually have to go through and look to see if there is sufficient electricity, what’s the infrastructure and most importantly, what are the human resources like… I don’t think Vietnam is going to be the producer that it thinks it is,” Zachary Abuza, a professor at the National War College in Washington, DC who focuses on Southeast Asia, told Al Jazeera.

Vietnamese authorities are aware of workforce shortcomings and are leading a push to train more engineers, said Nguyen Thanh Yen, a principal engineer at the Hanoi branch of the Korean chip design company CoAsia SEMI.

“The government is now aggressively planning dedicated programmes to boost up the number of semiconductor engineers,” Yen told Al Jazeera.

Semiconductors were a centrepiece of the historic upgrade in relations between Vietnam and the United States announced in September, when the two countries agreed to a comprehensive strategic partnership – the highest tier in Hanoi’s diplomatic hierarchy.

“We’re deepening our cooperation on critical and emerging technologies, particularly around building a more resilient semiconductor supply chain,” US President Joe Biden said during a September 9 joint press conference with Nguyen Phu Trong, the general secretary of the Communist Party of Vietnam.

US chip companies appear to be aligning with Washington’s agenda.

Arizona-based Amkor started operations at a $1.6bn chip factory in northern Vietnam this October, while Delaware-headquartered Marvell announced in May that it would establish a semiconductor design centre in the country.

South Korean firms are also joining the rush. Samsung, Vietnam’s largest investor, announced in August 2022 that it would invest $3.3bn to manufacture semiconductor components in the country.

Hana Micron Vina, which specialises in chip packaging and memory products, is building a second factory in Vietnam and plans to invest $1bn in the country by 2025, according to a Nikkei Asia report.

Chip firms are “all competing for this very small, tight labour market,” Abuza said. “[Vietnam] is going to have to increase their rate of engineers by like five times annually to do this.”

Others such as Yen are optimistic about Vietnam’s ability to rise to the challenge.

He said the country excels in math and science and 20 technical universities are starting semiconductor training programmes with the goal of having 50,000 engineers added to the workforce by 2030.

“Vietnam has the advantage of young and hungry human resources,” Yen said. “The fields that help them make money most easily are typically in the technical sectors. Semiconductors are getting hot now.”

Help is also coming from outside.

During his visit to Vietnam, Biden announced $2m in seed funding for training in Vietnam’s semiconductor industry.

Europe could be next to get involved, said Bruno Sivanandan, the co-chairman of the Digital Sector Committee at the European Chamber of Commerce Vietnam.

“There may be partnerships with academies in Europe to support the education of Vietnamese workers,” Sivanandan told Al Jazeera. “Vietnam has such a huge potential that is not yet realised, so the big players are looking to Vietnam.”

Still, Vietnam may not have the luxury of time with regional challengers vying for investment.

Hiep at ISEAS said Malaysia and Singapore were formidable competitors and Indonesia and Thailand were also pursuing the sector.

“Everybody is looking for opportunities to establish their presence in the global chip supply chain,” Hiep said. “It is a very, very competitive Industry.”

Energy insecurity is also a challenge.

During Vietnam’s hottest summer to date last year, northern locales experienced intermittent blackouts. In early June, the weather was so sweltering during a Hanoi power outage that some families sought refuge in a mountainous cave near the city centre.

For several weeks, factories in industrial parks in northern Vietnam went dark for hours at a time during the afternoons.

“They had to stop operations because there was no energy in the middle of the day for about four or five hours,” a Ho Chi Minh City-based individual working in the energy sector told Al Jazeera, asking for his name to be withheld as he had not been cleared by his company to discuss the topic.

“Samsung and other Korean factories – they were in a huge crisis because they had to stop their factories completely because of the lack of electricity.”

After the outages, authorities launched an investigation into EVN, the country’s state-run electricity provider. Officials ultimately disciplined 161 EVN personnel over the power shortages.

Northern Vietnam is heavily dependent on hydropower dams, which can dry up during the hottest months of the year when demand is at its highest. Infrastructure is outdated and the country “lacks the grid capacity and the power resources to deal with the problem”, the energy sector employee said.

“We should have invested in the power transmission and power resources in the North of Vietnam many years ago but EVN, they fell behind,” he said.

“In the north of Vietnam, [factories] will face a huge problem in relation to energy security.”

Energy is also a concern for European investment.

Under the terms of the European Union’s trade deal with Vietnam, European companies doing business with the country must abide by increasingly stringent regulations on carbon emissions, which could pose problems as long as Vietnam relies heavily on coal.

“To do business with Europe, you need to fulfil those requirements on carbon emissions,” Sivanandan said. “If we apply this to the semiconductor industry, this is going to be a barrier.”

Abuza said there is a considerable gap between Vietnam’s potential and the reality on the ground.

“These chip factories and server farms and all the high-tech stuff Vietnam wants to do really relies on very steady electricity and they just don’t have it,” he said. “Vietnam has amazing potential for investors but there is so much they have trouble resolving.”

[ad_2]